Research Projects

Are Banks Technologically Obsolete? A New Monetarist Approach. Jimenez (2020, working paper)

Abstract

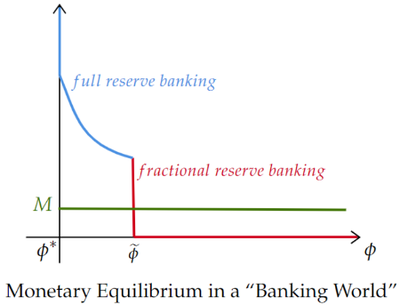

Compared to historical manifestations of base monies like spices, bullion or coins, today’s state of technology and institutions related to base monies seems to make private banks more likely to become obsolete as the main providers of retail payment instruments and services. To provide insights into this issue, we build a monetary search model where transferring the medium-of-exchange (MOE) entails dealing with transfer costs, imperfect supply elasticity, and asymmetric information in its value. Banks are special because they are experts in assaying the quality of the MOE and have access to a retail payment infrastructure. The latter allows banks to issue unlimited unforgeable and cheaper-to-transfer debt but at the expense of possible discounts motivated by the debt heterogeneity created when money is provided by more than one institution. Given this model, we first show what we call the “Two Worlds” result, which allows us to partition the parameter space into two sub-spaces that speak to the relevance of banking in the competitive equilibrium. Our main result suggests that the extent of near-future obsolescence depends on a sort of “race” between private banks and Central Banks on future innovations in retail payments. Formally, suppose we start from a parameterized model consistent with being in a Banking World, where only bank debt is used for exchanges. Then, if asymmetric information and transfer costs on the MOE converge to private standards, even with an arbitrarily good private payment infrastructure, the environment converges to a Non-Banking World. In this world, agents demand only the MOE for payments. However, we also show that if instead MOE transfer costs become arbitrarily close but still higher than private standards, and bank debt transfers become as homogeneous as transferring funds within a Central Bank, then the environment remains a Banking World. Therefore, our main results suggest that ultimately the near future obsolescence of private banks depends on whether they offer fast and seamless bank debt transfers that resemble what would be like transferring debt within the same institution like a Central Bank. These private innovations would also need to compensate for future public innovations in the cost of retail transfers of Central Bank debt.

The Life-Cycle of Banking Jimenez (2022, working paper)

Abstract

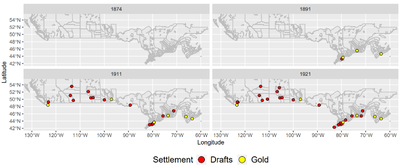

This paper is the first to document the evolution of a domestic banking system from inception to maturity, defined in terms of its turnover dynamics. I digitize multiple novel historical sources for Canada from the founding of its first bank in 1817 up to 1933, after which there was no turnover event for twenty years. I provide a broad set of stylized facts related to three themes: Turnover and market shares, branching and financial networks, and portfolio choices. Regarding major results related to the first theme, I show a tendency towards market concentration. The industry shows an inverted “V-shaped” evolution for the number of incumbent banks that converges to having just ten large banks down from a peak of 51. Overall, while smaller banks fail and get liquidated, large banks merge with medium-sized banks. Market shares are also quite persistent since banks tend to stay in the same market share quartile across 5-year windows. Next, in terms of branching and financial network facts, I show that banks tend to branch more in locations with higher populations and with access to a means of transportation. Moreover, a higher proportion of branches in a Province predicts a higher chance of having more branches in that same Province next year. I also show the evolution of the correspondent financial network over the life-cycle of the industry. It starts almost disconnected with few nodes and links, evolves towards an almost fully connected one with many nodes and links, and ends again almost disconnected with few nodes and links. Moreover, most links originate from smaller banks to a handful of large banks, with fewer links among the largest banks. What predicts having a correspondent or respondent relationship in a particular Province? First, having a branch located where a Provincial Clearing House increases the chance of having a respondent for that Province, and not having a branch in that location increases the chance of having a correspondent there. Second, if a bank has at least one branch in a Province that is connected by train with the other Province, that bank has a higher chance of having both a correspondent and a respondent in this other Province. I interpret this finding as one related to the idea that transportation routes lower trading costs and increase inter-location trade. Third, while the proportion of branches located in a Province doesn’t predict having a correspondent there, it does predict the chance of providing correspondent services in that Province to a respondent. Finally, in terms of portfolio choices, overall, I find banks that branch to a higher number of locations have lower loan and liquidity risk and higher leverage, which is consistent with a “diversification” channel on both sides of the balance sheet. Moreover, larger banks have a larger portfolio share of liquid and safe assets, above and beyond their needs for liquidity management purposes. I interpret this as larger banks having a larger “precautionary” buffer due to incentives to (partially) internalize systemic risk.

The Extent of Financial Fragility in Unregulated Banking Systems: Evidence from Canada, 1871-1913. Jimenez (2021, work in progress)

Abstract

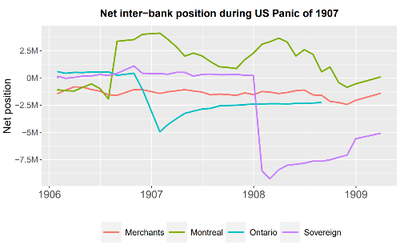

This paper challenges the conventional view that unregulated banking systems are “robust-but-fragile”, where banks provide valuable services during normal times but are also susceptible to a systemic run under financial stress. We use novel and granular data for Canada from 1871 to 1913, a period where there was no Central Bank, no currency monopoly, no deposit insurance, no explicit nor implicit bailout guarantees, no liquidity requirements, no mandatory public audits or inspections, and no public resolution authority. In this context, we show, among other things: i) The system evolved towards a handful of cooperative and well-diversified large banks, with no need for correspondent relationships. ii) Banks self-organized under an association that implemented centralized daily net clearing and settlement, liquidity management oversight, and rules for crises management and resolution. Moreover, the largest banks acted as ad-hoc central bankers by being lenders of last resort and making assume-and-purchase agreements with others at the brink of failure. iii) There were no system-wide runs even though Canada’s principal trading and financial partners (the US and UK) did have several. However, the system experienced some localized financial distress, and several bank failures were accompanied by fraud from top executives to both shareholders and creditors. The paper suggests that more work needs to be done in modern quantitative banking models to disentangle purely decentralized mechanisms from policy-induced microstructure. It also underscores the complexities in modeling and doing counterfactuals on path-dependent systems.